Business

Q.ai Review – An AI-Powered Investing App From Forbes

When it comes to passive investing, popular options include using a robo-advisor or just investing in various ETFs and index funds.

These are tried-and-true ways to build wealth. But they’re also missing out on a strategy some of the largest hedge funds and wealthy investors use to protect their portfolios: hedging.

But with Q.ai, a new AI-powered investing app from Forbes, everyday investors can invest similarly to hedge funds starting with just $100. And there’s a wide range of portfolios to choose from, so you’re not stuck with just a handful of funds.

Our Q.ai review is covering how this new app works, the pros and cons, and what risks you should consider before investing.

Q.ai Review

Features – 9

Commission & Fees – 10

Ease-Of-Use – 6

Historical Performance – 4

Customer Service – 4

Portfolio Variety – 8

6.5

Total

Q.ai is an AI-powered investing app from Forbes that lets you invest in a wide range of portfolios. Its unique selling point is that many portfolios have a hedging feature to provide downside protection. And portfolios also invest in a range of assets like stocks, ETFs, commodities, and crypto.

Pros & Cons

pros

- A low $100 funding requirement

- Q.ai is completely free

- Wide variety of portfolios to choose from

- Portfolio Protection uses hedging to help protect your portfolio

- New customers get a $100 bonus

- Q.ai invests in a range of assets like ETFs, stocks, crypto, and commodities

cons

- Since Q.ai is relatively new, its track record is quite limited

- Recent app store reviews complain about slow and non-responsive customer service

What Is Q.ai?

Q.ai is an AI-powered investing app that’s also a Forbes company. The app lets you invest in a range of portfolios across various sectors and themes. And, it uses AI-powered hedging for many portfolios to provide downside protection.

is an AI-powered investing app that’s also a Forbes company. The app lets you invest in a range of portfolios across various sectors and themes. And, it uses AI-powered hedging for many portfolios to provide downside protection.

This hedging strategy is the most unique selling point for Q.ai. Historically, investing in this hedge-fund style has only been possible if you’re an accredited investor and very wealthy. But through its AI-powered portfolios, Q.ai is striving to bring this type of investing to everyday consumers.

What Makes Q.ai Great?

There are two main selling points for Q.ai: its use of hedging and the sheer number of portfolios you can invest in. Plus, there are a few other nice-to-haves that make this new platform quite exciting.

Variety of Investment Kits

Similarly to robo-advisors that invest in portfolios of stock and bond-based ETFs, Q.ai invests in “Investment Kits” that are generally made up of five to 20 securities. But the difference is that Investment Kits can contain stocks, ETFs, commodities, and even crypto.

Additionally, Q.ai has four different collections to choose from, with each collection having a variety of Investment Kits that match a certain theme:

- Foundation: Includes kits for emerging tech, global trends, smart beta, and a value vault.

- Limited Edition: Includes kits for infrastructure, inflation protection, Bitcoin’s breakout, the global microchip shortage, and other niche themes based on current events.

- Specialty: Includes kits for clean tech, guilty pleasures, precious metals, and crypto.

- Community: Invests in the Forbes Kit, which uses sentiment analysis and data from Forbes to invest in U.S. stocks, international stocks, and ETFs.

The Limited Edition and Specialty Kits are quite unique versus robo-advisors or even more actively-managed competitors like Titan. And Q.ai does all of this off the back of its AI. Plus, the Forbes Kit is completely unique to Q.ai, although time will tell how successful this investing strategy is in the long-run.

AI-Powered Hedging

Another unique selling point of Q.ai is its Portfolio Protection feature that provides downside protection from the market through hedging. This is the same strategy hedge funds use to help protect their wealthy clients, hence the name.

Essentially, Q.ai’s AI tries to anticipate market risks like inflation, recessions, interest rate changes, oil prices, and general volatility. If its AI predicts a change in a certain risk factor, it can hedge part of your portfolio by converting some assets to cash. It also invests in traditional inflation hedges like commodities.

All Foundation Kits have Portfolio Protection as an option, and you can enable it for no extra cost. However, this can reduce your overall returns versus the market since hedging generally trades some returns for extra security. But if the risk factors Q.ai predicts arise, you’d be better off with hedging than without.

Again, this is a pretty unique selling point for Q.ai since this is a strategy actively-managed hedge funds generally use, not automatic investing platforms.

AI & DIY-Portfolios

There are two ways you can invest with Q.ai once you fund your account:

- DIY: This option lets you invest in a variety of Investment Kits of your choosing. Over time, Q.ai can change the holdings in each kit depending on its algorithm, but it won’t change your overall kit allocation percentages.

- AI-Powered: With the AI-portfolio, you don’t get to manually adjust your kit asset allocation. Instead, Q.ai rebalances your Portfolio Kits every week to help reduce risk and seek greater performance.

Low Minimum Investment Requirement

There’s a $100 funding requirement for Q.ai, which is in the same ballpark as robo-advisors like Betterment or Wealthfront. However, Investment Kits have varying minimum funding requirements ranging from just $10 to $250 for most of the different options.

Just note that there’s a $1,000 minimum if you want to use Q.ai’s AI-powered portfolio instead of the DIY route.

$100 Sign-Up Bonus

At the time of writing, Q.ai is giving new customers a $100 bonus if they open an account and make the minimum $100 deposit. This is an exceptional promotion since oftentimes, robo-advisor and stock broker promos require depositing thousands of dollars to earn similar amounts.

Potential to Outperform the Market

Since Q.ai uses hedging and also invests in a wide range of asset classes, it has the potential to outperform the general market. This is especially true if its hedging is successful and markets take a serious downturn.

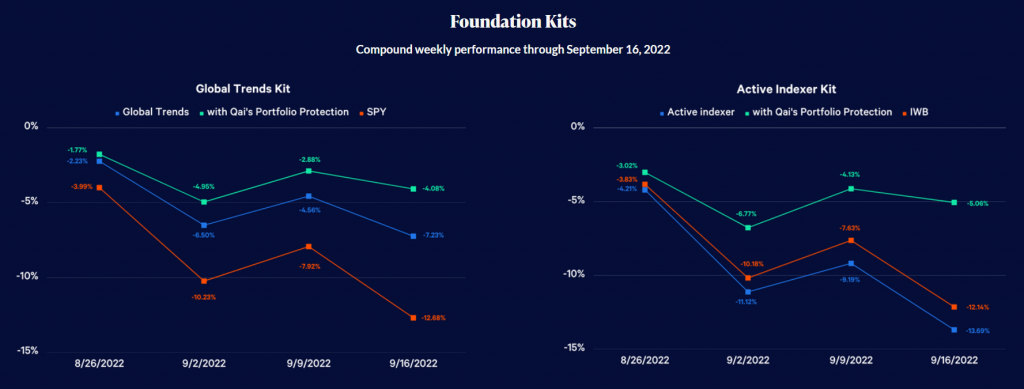

Take these two Portfolio Kits in the Foundations Kits collection as an example. As you can see, markets have been taking it on the chin at the time of writing, with both the SPY and IWB being down over 12%. Both Q.ai’s kits are down as well, but by significantly less thanks to Portfolio Protection.

In fact, the difference is almost 10% for both kits, and this is a similar story for many funds according to Q.ai’s historical performance data.

Again, time will tell if this trend continues. But I’m excited to see how these portfolios perform when the market is trending upwards.

What Are Q.ai’s Drawbacks?

There’s a lot of exciting stuff going on under the hood with Q.ai, especially when you compare its hedging strategies against ordinary robo-advisors. However, there are some downsides investors should consider before opening an account.

Limited Track Record

To its credit, Q.ai is very transparent, listing its historical performance for each kit on its website. But year-to-date performance for 2022 is as much data as we have, and every kit is down except for precious metals and the U.S. Outperformance Kit. And some kits, like crypto, are down over 60% at the time of writing.

This isn’t really a fair picture since markets have been painful for most of 2022, and anyone who invested in Bitcoin or Ethereum this year is probably feeling the pinch. But it also means it’s hard to evaluate if Q.ai is onto something or not.

Its hedging results certainly seem promising since it’s at least performed less-poorly than the general market. But this is an early-stage investment, so proceed with caution.

Negative App Store Reviews

The main reason I wouldn’t personally invest with Q.ai right now is because of the recent string of negative app store reviews. The app currently has a 3.8 star rating with 127 ratings in total. But many users complain about a clunky, confusing interface. And, even worse, some users report poor customer service and waiting for weeks to liquidate their accounts to get their money back.

For example, here’s what one recent one star review says:

“I asked for my account to be liquidated and the funds returned to my bank account 2 weeks ago. Nothing has taken place. Wrote into customer service days ago and have not received any response. There appears to be no phone # to call to get help. Trades continue to take place without my approval. Very concerned with the lack of action, communication, and control on my part. Would strongly warn people that they may have no control when depositing money with this app.”

The app is still very new, so bumps along the way are somewhat expected. But having several reviews complaining about slow liquidation or a lack of it altogether is concerning.

Missing Some Assets

At the time of writing, Q.ai doesn’t invest in preferred stocks, mutual funds, or fixed-income investments like bonds. This won’t be a deal-breaker for everyone, but it’s worth noting since many robo-advisors often use bonds to generate more reliable income.

Q.ai Historical Performance

As mentioned, Q.ai displays all of its historical performance data on its website, which I love. All of the data is broken-down by individual Portfolio Kits as well.

Pretty much every portfolio is down, ranging from a few points to -20% or more for several funds. Overall, Q.ai has been on the losing side for pretty much every portfolio. But, as mentioned, it’s often suffered less than the S&P 500 or various indexes which are also down.

I think Portfolio Protection is incredibly promising, and the data supports this since it seriously reduced the losses for the Portfolio Kits seen below.

However, I think it’s far too early to tell how Q.ai might perform, so investors should keep this in mind.

How Much Does Q.ai Cost?

According to its website, Q.ai doesn’t charge any trading or account management fees. This means it’s completely free to use at this time.

According to its website, the app will likely cost $10 per month at some point when the limited-time free period ends. It might add extra perks as well, like options trading strategies, for an extra fee as well.

For now, Q.ai is cheaper than many robo-advisors since you can’t beat free. But if and when it changes to $10 per month, you’d have to invest $48,000 for the $120 annual fee to equal 0.25% in annual management fees, which is what leading robo-advisors charge. But paying slightly more in fees on a small portfolio could be worth it for hedging.

Is Q.ai Safe?

When you invest with Q.ai, your account is held at Apex Clearing, which is a SEC-registered broker-dealer that also provides SIPC and FDIC insurance on your securities and cash.

This makes Q.ai safe to invest in from an insurance perspective. However, performance isn’t guaranteed, and past performance isn’t an indicator of future performance either.

Its website also says you can request a withdrawal of any amount at any time, although recent reviews have complained this isn’t true.

Best Alternatives

The main selling point of Q.ai right now is that it’s not your everyday robo-advisor. In reality, it’s an AI-powered investment platform that’s a middle ground between using a robo-advisor and investing through a hedge fund.

However, as a relatively new platform, some investors might not feel comfortable funding an account yet. And there are other Q.ai alternatives you can use to still invest on autopilot:

| Highlights |  |

|

|

|---|---|---|---|

| Rating | 9/10 | 9/10 | 8.5/10 |

| Minimum to Open Account | $0 | $500 | $0 |

| 401(k) Assistance |

|

|

|

| Two-Factor Auth. |

|

|

|

| Advice Options | Automated, Human Assisted | Automated | Automated |

| Socially Responsible Investing |

|

|

|

|

Sign Up

Betterment Review |

Sign Up

Wealthfront Review |

Sign UpM1 Review

|

Robo-advisors like Betterment and Wealthfront are the main players in the industry, and both invest in portfolios of stock and bond-based ETFs. You pay 0.25% in annual management fees with both robos, and overall, they’re more conservative than Q.ai, which includes more asset classes and niche portfolios.

M1 is more of a hybrid between a robo-advisor and an online broker. It also has a “hedge fund followers” pie, which is what it calls portfolios, you can invest in for something a bit similar to Q.ai. But the level of hedging Q.ai offers with Portfolio Protection is very unique for passively, AI-powered funds.

Bottom Line

Personally, I think it’s a bit too early to invest through Q.ai. But I’m not generally an early adopter of technology; I like to wait for the dust to settle before jumping in, especially if it involves money.

If you’re like me, it might be best to wait for Q.ai to gather more historical performance data. And as markets turn around, I’m very keen to see how its Portfolio Kits compare versus the market.

However, if you’re more adventurous and want to try something very different from a normal robo-advisor, Q.ai could be for you. The low investment minimum and $100 bonus also sweeten the deal. Just be sure you understand the risks, and know that recent reviews have been tough on customer service and getting your money out if you liquidate.

The post Q.ai Review – An AI-Powered Investing App From Forbes appeared first on Investor Junkie.