Business

Student Loan Forgiveness Application Form Now Available [Don’t Procrastinate]

A beta version of the student loan forgiveness application for the President’s student loan forgiveness plan became available on Friday, October 14, 2022. The U.S. Department of Education is using the beta version to test the form’s functionality and the capacity of their web servers. A full launch of the forgiveness application may soon follow.

A Federal Register Notice scheduled for publication on Monday, October 17, 2022 notes that the U.S. Department of Education received emergency use authorization for the form by October 7, 2022. The Federal Register Notice also opens a 60-day public comment period ending on December 16, 2022, but the form can be used prior to the end of the public comment period due to the emergency use authorization, which runs through April 30, 2023.

Borrowers should submit the student loan forgiveness application form immediately, as the timing of their application may affect whether they receive student loan forgiveness. Don’t procrastinate!

Apply For Student Loan Forgiveness Immediately

Borrowers should apply for forgiveness immediately, even though they have until December 31, 2023 to submit the student loan forgiveness application.

Republicans have filed several lawsuits that seek to block the President’s student loan forgiveness plan. Before these lawsuits can be considered on the merits, the plaintiffs must demonstrate that they have legal standing to file a lawsuit. Some of the cases have already been dismissed for a lack of legal standing. Others are still pending.

If Republicans succeed in demonstrating legal standing, and get any of their cases considered on the merits, the courts may block the President’s student loan forgiveness plan.

But, borrowers who have already received forgiveness may get to keep that forgiveness, as the courts are unlikely to require the U.S. Department of Education to claw back that forgiveness.

Forgiveness is planned to occur within 4-6 weeks after the application is submitted. (In a court filing, the U.S. Department of Education said there will be no forgiveness before October 23, 2022, but that doesn’t mean the application won’t be available before then, since it takes 4-6 weeks after application for forgiveness to occur.)

So, it is important for borrowers to apply for forgiveness as soon as the forgiveness application form becomes available.

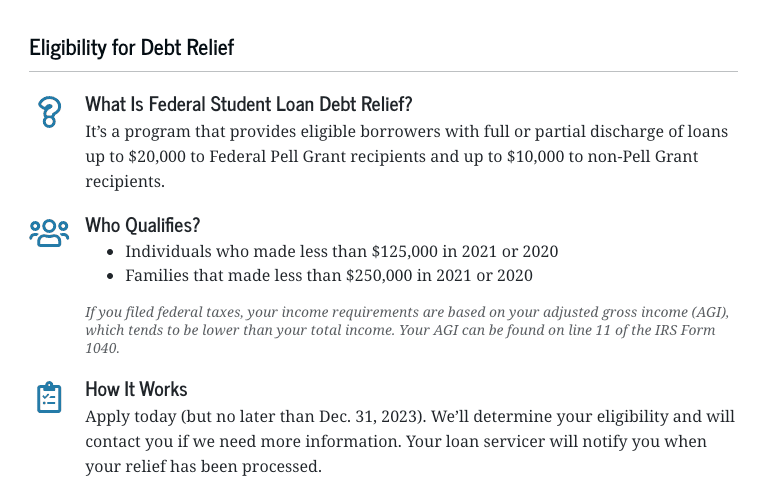

How To Prepare For The Forgiveness Application Form

Borrowers who have eligible federal student loans can prepare to submit the student loan forgiveness application by gathering their income data from 2020 and 2021. Borrowers whose income in either year is less than $125,000 (single or married filing separately) or $250,000 (married filing jointly, head of household or qualifying widow(er)) will qualify. Income is based on adjusted gross income (AGI) from line 11 of IRS Form 1040. More than 90% of borrowers will satisfy the income requirements.

For students who are still in college, students who are considered to be independent should file the forgiveness application form using their own income information. Otherwise, if a student is considered to be a dependent student, they should file the forgiveness application form using their parents’ information. Yes, students still in college can get loan forgiveness.

How To Apply For One-Time Student Loan Forgiveness

The loan forgiveness application is available at studentaid.gov/debt-relief/application. Additional information may be found on the StudentAid.gov website.

During the beta test, only some borrowers are able to see and submit the application.

Other borrowers should reload the application periodically, until they are allowed to access the application.

Borrowers who submit the beta version of the forgiveness application will not need to resubmit the form when it officially launches. Applications submitted during the beta test will be processed after the official launch of the forgiveness application form. The U.S. Department of Education says, “There’s no advantage to applying before the full launch.”

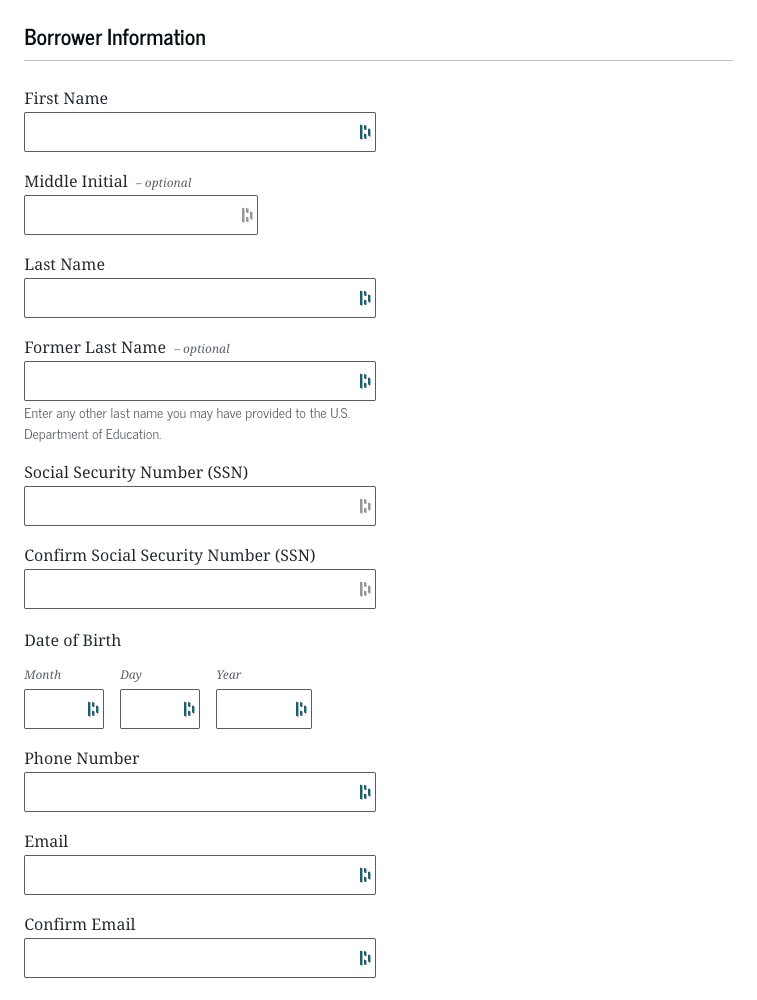

It takes less than 5 minutes to submit the forgiveness application form. The application is simple and straightforward. Borrowers do not need to login with an FSA ID or upload documents. The form asks for the borrower’s name, Social Security Number, date of birth, phone number an email address.

The forgiveness application also includes a simple attestation, made under penalty of perjury, that the borrower qualifies for the President’s student loan forgiveness plan.

You do not need to specify whether you previously received a Federal Pell Grant, which qualifies you for up to $20,000 in student loan forgiveness, because the U.S. Department of Education already knows your Federal Pell Grant recipient status.

Don’t lie on the forgiveness application form. If you lie, you may have to pay fines of up to $20,000 in addition to disgorgement of the forgiveness you received and be imprisoned for up to five years. There may be additional fines and jail time under mail fraud and wire fraud statutes.

Some borrowers may be asked to verify their income by March 31, 2023. If you are asked to verify your income, you’ll be prompted to login with your FSA ID and upload a copy or your 2020 or 2021 tax return or other verifying information.

Past Penalties For Procrastination

After the President announced his student loan forgiveness plan on August 24, 2022, it was limited to loans first disbursed by June 30, 2022. New loans disbursed on or after June 30, 2022 were ineligible.

This would have prevented borrowers with loans in the Federal Family Education Loan Program (FFELP) from consolidating their loans into the Direct Loan program to qualify for the President’s student loan forgiveness plan.

The U.S. Department of Education responded by allowing Federal Direct Consolidation Loans made after June 30, 2022 to qualify, provided that the consolidation loan included only loans disbursed before June 30. This allowed borrowers with FFELP loans to consolidate their loans to qualify for forgiveness.

However, six state attorneys general filed a lawsuit to block the President’s plan based on the impact of the President’s plan on their FFELP loans. To have legal standing to file a lawsuit, they need to demonstrate that they are harmed by the President’s plan. Allowing borrowers to consolidate their FFELP loans to obtain student loan forgiveness, reduces the states’ student loan volume.

The U.S. Department of Education responded by limiting eligibility for consolidation of FFELP loans to applications for consolidation made prior to September 29, 2022, the date the lawsuit was filed. This eliminates the legal standing of the state attorneys general, thereby blocking their lawsuit.

Borrowers who had not yet applied for consolidation of their FFELP loans are out of luck. There’s nothing they can do to make their FFELP loans eligible for the President’s plan.

This demonstrates why it is important for borrowers who do qualify for the President’s plan to not procrastinate. You should apply for forgiveness as soon as possible because you never know when the rules might change or if delays can cause you to lose eligibility for forgiveness.

Editor: Robert Farrington

The post Student Loan Forgiveness Application Form Now Available [Don’t Procrastinate] appeared first on The College Investor.