Business

What Is A Credit Builder Loan And How Does It Work?

When you have bad credit or no credit at all, your financial life is often more challenging than it needs to be. After all, lenders and credit card issuers are hardly lining up to offer bad credit or no credit borrowers reasonable financing opportunities.

When it comes to credit, one of the best ways to build it is by making on-time payments to a credit account. But if you can’t open a credit card or obtain a traditional loan, you might feel stuck – where do you start?

That’s when a credit builder loan can be a useful tool because it offers the chance to build credit by making on-time payments without a traditional loan product. Whether you want to rebuild your credit or build your credit from scratch, a credit builder loan may be able to help.

We’re partnering with CreditStrong to help you understand what credit builder loans are and how they work. For as little as $15/mo, you can build credit history AND your savings at the same time. Open a CreditStrong credit builder account and get started >>

Let’s take a closer look at what these unique loan types have to offer.

What Is A Credit Builder Loan?

As the name suggests, a credit builder loan is designed to help you build credit. You may also hear credit builder loans referred to as fresh start loans or starting over loans.

Unlike a traditional loan product, you won’t receive any funds upfront when taking out a credit builder loan. But this non-traditional loan product gives you an opportunity to make on-time payments.

How Does A Credit Builder Loan Work

Credit builder loans give you a chance to build credit and savings at the same time. Whether you are rebuilding your credit score or starting from the beginning, a credit builder loan operates in the same way.

The process starts by opening a credit builder loan. Many credit builder loan providers don’t run a credit check to approve your loan application. After all, they realize that you are looking for a way to build credit, and a hard credit inquiry won’t help with that.

If approved for a credit builder loan, the issuer will set up a savings account or certificate of deposit (CD) in your name. The principal balance from your loan will be placed into this earmarked account, but the account will remain locked until the end of the loan term.

Once the loan is finalized, you’ll start making regular monthly payments to the lender. Typically, the loan term ranges from six to 24 months, but you can sometimes find longer loans if you need a lower monthly payment. As you make payments, the lender will report this loan activity to the credit bureaus.

CreditStrong

For as little as $15/mo, you can build credit history AND your savings at the same time. Open a CreditStrong credit builder account and get started >>

With each payment, a portion will go towards paying back the principal balance. Essentially, the principal balance acts as a way to build savings. The remainder of the payment will cover interest charges, compensating the lender for this credit-building opportunity.

If you make all of your payments by the end of the loan term, you’ll get access to the locked savings account. With that, it’s possible to grow your savings while building your credit.

In the case of CreditStrong, they have several products that help you build credit, and all do similar to this – where you can save and build a credit history at the same time.

Costs Of A Credit Builder Loan

The costs of a credit builder loan vary from lender to lender. At the very least, you should expect to pay interest charges on your credit builder loan. But you might also find the following fees attached:

- Administrative: Some lenders charge an administrative fee to cover the costs of starting your credit builder loan.

- Membership: Some lenders offering credit builder loans require a membership fee to gain access to their loan products.

- Late fee: If you miss a payment due date, you might get stuck paying a late fee.

When shopping around for a credit builder loan, take a close look at the fees. You can find a lender that suits your budget and your credit-building needs.

For example, CreditStrong’s cheapest plan starts at just $15/mo, or you could choose a plan with only a $99 annual fee and no required monthly payment (about $8.25/mo when you work it out!).

Can A Credit Builder Loan Help Your Credit Score?

A credit builder loan gives you an opportunity to add positive information to your credit report. However, that doesn’t mean it will automatically boost your credit score. Instead, the potential rewards vary based on how you manage the loan and your existing credit history.

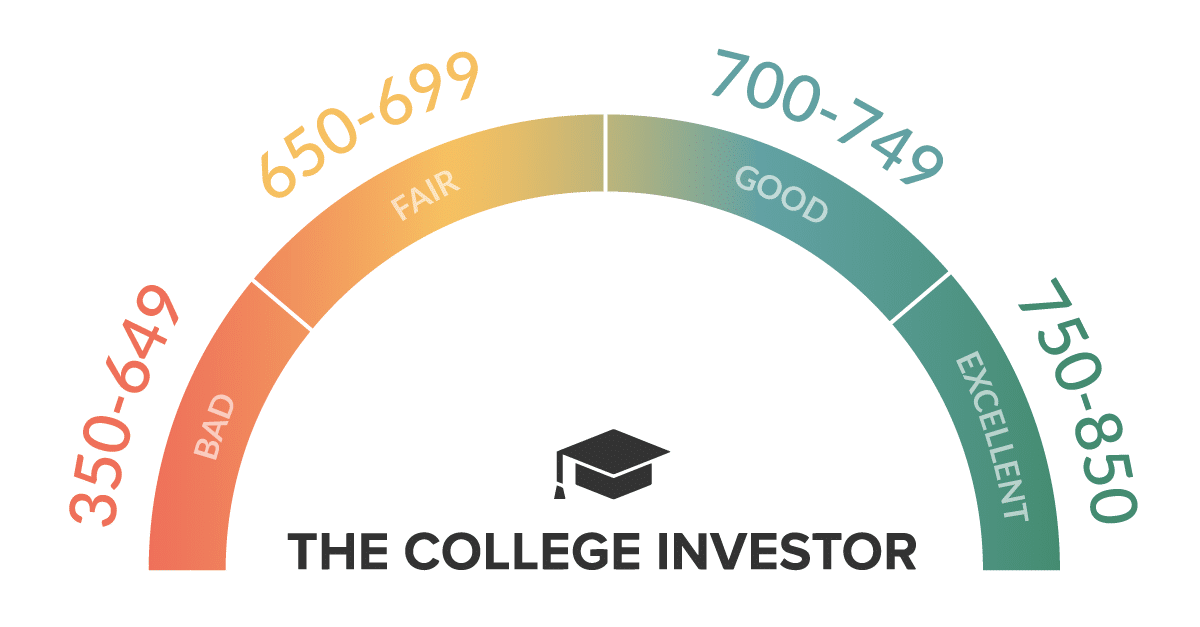

If you make on-time payments to your credit builder loan, that could have a positive impact on your credit score. Payment history accounts for 35% of your credit score. So, making on-time payments gives you a chance to improve your score.

But if you don’t make on-time payments, that adds negative information to your credit report. With that, it’s possible to damage your credit score if you cannot keep up with the credit builder loan payments.

Is A Credit Builder Loan Worth It?

According to the Consumer Financial Protection Bureau, “a credit builder loan could increase the likelihood of establishing a credit record for consumers without one, and could help improve the credit scores of those with no current outstanding debt.”

But whether or not a credit builder loan is worth it varies based on your unique situation.

If you are planning to make a major purchase with the help of financing in the future, the chance to improve your credit score could save you thousands of dollars on interest payments. But if you only plan to make cash purchases for the foreseeable future, then even the very best credit score won’t have a big impact on your plans. Keep in mind your credit score also affects things like your car insurance rates, so even if you mostly use cash your credit score still may impact your finances.

Take some time to consider how a better credit score could impact your financial future. For example, if you are planning on taking out a mortgage, then a good credit score is essential. If you aren’t sure what your financial future holds, it’s often worth it to start building credit now in case you need it down the line.

CreditStrong: A Credit Builder Loan Opportunity

When you start shopping for a credit-building loan opportunity, you’ll find plenty of options. But CreditStrong offers one of the most worthwhile credit builder loan options.

If you are looking to build credit, CreditStrong’s Instal loan could be the solution you’ve been looking for. Before moving forward, scope out the fees with your various credit builder loan options to find the best fit for your wallet.

Want to learn more about CreditStrong? Take a look at our full review.

Summary

Opening a credit builder loan doesn’t guarantee a higher credit score. But it does offer an opportunity to move your credit score in the right direction by building a solid history of on-time loan payments.

Take a closer look at what Credit Strong has to offer.

Editor: Claire Tak Reviewed by: Robert Farrington

The post What Is A Credit Builder Loan And How Does It Work? appeared first on The College Investor.